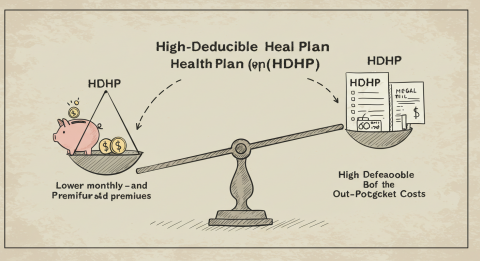

High-Deductible Health Plans (HDHPs) have become increasingly popular in recent years as employers and individuals seek ways to manage rising healthcare costs. These plans promise lower monthly premiums in exchange for higher out-of-pocket expenses when you need medical care. While HDHPs can be an excellent choice for some people, they’re not suitable for everyone.

Understanding how HDHPs work, their benefits and drawbacks, and whether they align with your financial situation and healthcare needs is crucial for making an informed decision about your health insurance coverage. This comprehensive guide will help you navigate the complexities of high-deductible health plans and determine if this type of coverage is right for you.

What Are High-Deductible Health Plans?

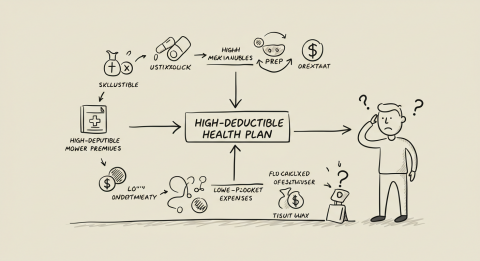

A High-Deductible Health Plan is a type of health insurance that requires you to pay a significant amount out-of-pocket before your insurance coverage begins to pay for most healthcare services. The Internal Revenue Service (IRS) sets minimum deductible amounts each year to qualify as an HDHP.

For 2024, the minimum deductible for an HDHP is $1,600 for individual coverage and $3,200 for family coverage. The maximum out-of-pocket limits are $8,050 for individuals and $16,100 for families. These thresholds are adjusted annually to account for inflation and healthcare cost changes.

HDHPs are designed around the concept of consumer-driven healthcare, where individuals take more responsibility for their healthcare spending decisions. The theory is that when people pay more directly for their medical care, they become more conscious consumers, shopping around for better prices and avoiding unnecessary treatments.

Most HDHPs cover preventive care services at no cost to you, even before you meet your deductible. This includes annual physical exams, routine screenings, immunizations, and other preventive services recommended by healthcare professionals. This feature encourages people to maintain their health through regular check-ups and early detection of potential health issues.

How HDHPs Function in Practice

When you enroll in an HDHP, you’ll pay relatively low monthly premiums compared to traditional health insurance plans. However, when you need medical care beyond covered preventive services, you’ll pay the full cost until you reach your annual deductible.

For example, if you have an HDHP with a $3,000 deductible and need surgery that costs $8,000, you would pay the first $3,000 out-of-pocket. After meeting your deductible, your insurance would typically cover a percentage of the remaining costs, with you paying coinsurance or copayments until you reach your out-of-pocket maximum.

The payment structure means that routine medical expenses like doctor visits, prescription medications, and diagnostic tests often come entirely from your own pocket until you meet the deductible. This can create a significant financial burden, especially early in the plan year or for people with ongoing health conditions.

Many HDHP members find themselves postponing non-urgent medical care or choosing less expensive treatment options to avoid high out-of-pocket costs. While this can help control healthcare spending, it may also lead to delayed care that could result in more serious and expensive health problems later.

Health Savings Accounts: The HDHP Advantage

One of the primary benefits of HDHPs is eligibility for Health Savings Accounts (HSAs). HSAs are tax-advantaged savings accounts specifically designed to help people with HDHPs pay for qualified medical expenses.

HSA contributions are tax-deductible, reducing your taxable income for the year. The money in your HSA grows tax-free through investment options, and withdrawals for qualified medical expenses are never taxed. This triple tax advantage makes HSAs one of the most powerful savings vehicles available.

For 2024, individuals can contribute up to $4,150 to an HSA, while families can contribute up to $8,300. People aged 55 and older can make additional catch-up contributions of $1,000. These contribution limits are adjusted annually for inflation.

HSAs offer significant flexibility that other healthcare accounts don’t provide. Unlike Flexible Spending Accounts (FSAs), HSA funds never expire and roll over year after year. You can invest HSA funds in mutual funds, stocks, and other investment vehicles, potentially growing your healthcare nest egg over time.

After age 65, you can withdraw HSA funds for any purpose without penalty, though non-medical withdrawals are subject to regular income tax. This feature makes HSAs valuable retirement planning tools, as healthcare expenses typically increase with age.

Who Benefits Most from HDHPs

HDHPs work best for specific types of people and situations. Understanding whether you fit these profiles can help you determine if an HDHP is appropriate for your circumstances.

Young, healthy individuals often benefit most from HDHPs. If you rarely visit doctors beyond annual check-ups and don’t take regular medications, the lower monthly premiums can result in significant savings. The money you save on premiums can be contributed to an HSA, building a fund for future healthcare expenses.

People with stable, higher incomes who can comfortably handle unexpected medical expenses are good candidates for HDHPs. If you have sufficient emergency savings and can afford to pay several thousand dollars out-of-pocket for medical care, the premium savings and HSA benefits can make HDHPs financially advantageous.

Individuals who are strategic about healthcare spending and comfortable researching treatment options and costs may thrive with HDHPs. These plans reward people who shop around for better prices, use generic medications when appropriate, and make informed decisions about their healthcare.

Families planning for future healthcare needs, particularly those thinking about retirement, can benefit from the long-term savings potential of HSAs paired with HDHPs. The ability to invest HSA funds and let them grow tax-free over decades can create substantial healthcare reserves.

People who prefer predictable budgeting might appreciate knowing their maximum annual healthcare costs upfront through the out-of-pocket limits, even though they may face higher initial expenses before reaching their deductible.

Who Should Avoid HDHPs

Despite their benefits, HDHPs are not suitable for everyone. Several groups of people should carefully consider whether these plans align with their needs and circumstances.

Individuals with chronic health conditions requiring regular medical care, prescription medications, or specialist visits typically fare poorly with HDHPs. The high deductibles mean these people often pay full price for their ongoing care, potentially spending thousands of dollars before insurance coverage begins.

People with limited financial resources or those living paycheck-to-paycheck should generally avoid HDHPs. The high out-of-pocket costs can create financial hardship, potentially leading to medical debt or delayed care. If you cannot comfortably afford to pay your full deductible in a medical emergency, an HDHP may not be appropriate.

Families with young children or individuals planning to start families should carefully evaluate HDHPs. Pregnancy, childbirth, and pediatric care can involve significant medical expenses that occur early in the plan year, resulting in high out-of-pocket costs before deductibles are met.

Older adults nearing retirement age often have increased healthcare needs and may prefer the predictability of traditional insurance plans with lower deductibles and copayments. While HDHPs can still be beneficial for some older adults, the potential for high out-of-pocket costs requires careful consideration.

People who prefer the simplicity of copayment structures for routine care may find HDHPs confusing and stressful. If you don’t want to think about the cost of every medical decision or research healthcare prices, traditional plans with predictable copayments might be more suitable.

Financial Considerations and Strategies

Successfully managing an HDHP requires careful financial planning and strategic thinking about healthcare expenses. Understanding the total cost of ownership, not just monthly premiums, is essential for making sound decisions.

Calculate your potential total annual healthcare costs under different scenarios. Consider your deductible, out-of-pocket maximum, and likely medical expenses to understand your worst-case financial exposure. Compare these figures to the total costs of traditional insurance plans, including higher premiums.

Building an adequate emergency fund becomes even more critical with an HDHP. Ideally, you should have enough savings to cover your full deductible plus additional emergency expenses. This financial cushion ensures you can access needed care without creating debt or financial strain.

Maximize your HSA contributions whenever possible to take full advantage of the tax benefits and build long-term healthcare savings. If your employer offers HSA contributions or matching, ensure you’re receiving the full benefit of these programs.

Develop strategies for managing healthcare costs, such as using generic medications, seeking care at lower-cost facilities, and taking advantage of preventive services that are covered at no cost. Many HDHPs offer tools and resources to help you find cost-effective care options.

Consider timing non-urgent medical procedures strategically. If you expect to meet your deductible early in the year due to planned procedures, it may make sense to schedule additional non-urgent care during the same year to take advantage of your met deductible.

Making the Right Decision

Choosing whether to enroll in an HDHP requires honest assessment of your healthcare needs, financial situation, and personal preferences. Consider both your current circumstances and how they might change over the plan year.

Review your past healthcare utilization to understand your typical annual medical expenses. Look at doctor visits, prescription costs, and any procedures or treatments you’ve needed. This historical data can help predict your likely costs under different plan structures.

Evaluate your employer’s health insurance offerings carefully, considering total compensation including any employer HSA contributions. Sometimes employers offer incentives that make HDHPs more attractive, such as contributing to your HSA or providing wellness programs that reduce your out-of-pocket costs.

Consider your family’s risk tolerance and ability to handle unexpected medical expenses. While insurance is designed to protect against unforeseen costs, HDHPs shift more financial risk to you as the policyholder.

Think about your healthcare preferences and whether you’re comfortable with the additional responsibility that comes with consumer-driven healthcare. HDHPs work best for people who are willing to actively manage their healthcare spending and make informed decisions about treatment options.

Conclusion

High-Deductible Health Plans can be valuable tools for managing healthcare costs and building long-term savings through HSAs. However, they’re not universally appropriate and require careful consideration of your individual circumstances.

HDHPs work best for healthy individuals with stable incomes who can handle high out-of-pocket costs and want to take advantage of HSA benefits. They’re less suitable for people with chronic conditions, limited financial resources, or those who prefer predictable healthcare costs.

The key to success with any health insurance plan is understanding how it works, what it costs, and how it aligns with your needs. Take time to carefully evaluate your options, consider both current and future healthcare needs, and choose the plan that provides the best combination of coverage, cost, and peace of mind for your situation.

Remember that health insurance decisions aren’t permanent – you can typically change plans during annual enrollment periods. If your circumstances change or you find that your current plan isn’t meeting your needs, you’ll have opportunities to make adjustments in the future.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.