Executive Summary

Merck & Co. (NYSE: MRK) stands as one of the world’s leading pharmaceutical giants, offering investors exposure to a diversified portfolio of blockbuster drugs, innovative pipeline candidates, and steady dividend income. With the company navigating the approaching patent cliff for its flagship cancer immunotherapy Keytruda, investors are closely watching how Merck’s strategic initiatives will drive growth in the second half of 2025 and beyond.

Company Overview: A Pharmaceutical Powerhouse

Merck & Co., known as MSD outside North America, represents over 130 years of pharmaceutical innovation. The company operates across multiple therapeutic areas including oncology, vaccines, infectious diseases, and cardiovascular health. With a market capitalization exceeding $200 billion, Merck maintains its position as a blue-chip pharmaceutical investment with global reach and proven drug development capabilities.

Key Business Segments

Oncology Division: Led by Keytruda (pembrolizumab), Merck’s oncology portfolio generates substantial revenue streams. Keytruda alone contributes billions in annual sales, making it one of the world’s best-selling cancer treatments.

Vaccines: The company’s vaccine portfolio includes Gardasil (HPV vaccine), pneumococcal vaccines, and other preventive treatments that provide stable, recurring revenue.

Infectious Diseases: Merck continues developing treatments for HIV, hepatitis, and other infectious conditions, with multiple pipeline candidates advancing through clinical trials.

Cardiovascular: The company is expanding its cardiovascular portfolio with innovative cholesterol-lowering therapies and other heart health treatments.

Current Financial Performance

Merck delivered strong financial results in Q1 2025, demonstrating resilience despite market challenges. The company announced Q1 worldwide sales of $15.5 billion, reflecting solid performance across its diversified portfolio.

Looking ahead, for 2025, the drugmaker expects revenue to come in between $64.1 billion to $65.6 billion, with adjusted earnings per share forecast between $8.88 to $9.03 per share. However, these projections came in below analyst expectations, with consensus estimates previously targeting higher revenue and earnings figures.

Dividend Commitment

Merck continues demonstrating its commitment to shareholders through consistent dividend payments. The Board of Directors has declared a quarterly dividend of $0.81 per share for the third quarter of 2025, maintaining the company’s reputation as a reliable dividend-paying stock.

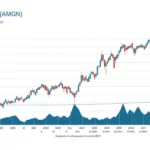

Stock Performance and Analyst Outlook

Current Valuation and Price Targets

Merck’s stock performance reflects both the company’s fundamental strengths and market concerns about upcoming patent expirations. Based on 17 Wall Street analysts, the average price target is $101.47 with a high forecast of $138.00 and a low forecast of $82.00.

The analyst community maintains a generally positive outlook on Merck’s prospects. According to 32 analysts, Merck (MRK) has a Buy consensus rating, indicating confidence in the company’s strategic direction and growth potential.

Price Forecasts for 2025

Multiple forecasting models suggest varied outcomes for Merck’s stock performance through 2025:

- The forecasted Merck price at the end of 2025 is $86.69

- According to stock prediction models, MRK stock will be priced between $74.03 and $96.59 in 2025

These projections reflect the inherent uncertainty surrounding pharmaceutical stocks, particularly given the competitive landscape and regulatory environment.

Strategic Initiatives and Pipeline Development

Addressing the Keytruda Patent Cliff

As Keytruda’s patent cliff looms, Merck is broadening its pipeline through strategic acquisitions, partnerships, and internal development programs. The company recognizes the critical importance of diversifying its revenue streams before losing exclusivity on its blockbuster cancer treatment.

Pipeline Expansion

Merck continues investing heavily in research and development, with several promising candidates advancing through clinical trials:

Winrevair (sotatercept): Beyond Winrevair, Merck will also read out its first pivotal study of its oral PCSK9 inhibitor to lower cholesterol in 2025. This oral cholesterol-lowering therapy could capture significant market share from existing injectable treatments.

HIV Portfolio: Merck has announced a virtual investor event scheduled for July 17, 2025, where the company’s scientific and commercial team leaders will present an overview of Merck’s advancing research pipeline focused on HIV treatment and prevention.

Strategic Partnerships: Merck expanded its pipeline through an exclusive license agreement with Hengrui Pharma for an investigational oral small molecule Lp(a) inhibitor, demonstrating the company’s commitment to external partnerships for growth.

Second Half 2025 Outlook: Key Factors to Watch

Growth Drivers

Pipeline Readouts: The second half of 2025 will feature critical data readouts from multiple late-stage clinical trials. Success in these studies could significantly impact Merck’s valuation and long-term growth prospects.

Market Expansion: International market expansion, particularly in emerging economies, presents opportunities for revenue growth across Merck’s established product portfolio.

Biosimilar Competition: While Keytruda faces eventual biosimilar competition, Merck’s strong market position and continued label expansions may help maintain market share longer than anticipated.

Risk Factors

Regulatory Challenges: The pharmaceutical industry faces ongoing regulatory scrutiny, particularly regarding drug pricing and market access. Policy changes could impact Merck’s profitability.

Competitive Pressures: Intense competition in oncology, with numerous companies developing immunotherapies and targeted cancer treatments, poses challenges for market share retention.

Manufacturing and Supply Chain: In February, Merck announced a decision to halt shipments of Gardasil into China beginning that month and going through at least mid-2025, highlighting potential supply chain disruptions that could impact revenue.

Investment Considerations

Strengths

- Diversified Portfolio: Merck’s broad therapeutic portfolio provides revenue stability and reduces dependence on any single product.

- Strong Pipeline: Robust research and development capabilities with multiple promising candidates in late-stage development.

- Financial Stability: Consistent cash flow generation supports dividend payments and continued R&D investment.

- Global Presence: Established international operations provide geographic diversification and growth opportunities.

Risks

- Patent Cliff: The eventual loss of Keytruda exclusivity represents a significant revenue risk requiring successful pipeline execution.

- Regulatory Environment: Ongoing healthcare policy debates and pricing pressures could impact profitability.

- Competition: Intense competition across all therapeutic areas requires continuous innovation and market differentiation.

Conclusion: Navigating Opportunities in H2 2025

Merck & Co. presents a compelling investment opportunity for investors seeking exposure to the pharmaceutical sector. The company’s strong financial position, diversified portfolio, and robust pipeline provide a solid foundation for long-term growth. However, the approaching Keytruda patent cliff and competitive market dynamics require careful monitoring.

For the second half of 2025, investors should focus on pipeline development progress, regulatory approvals, and management’s execution of strategic initiatives. While near-term headwinds exist, Merck’s historical track record of successful drug development and commercialization suggests the company is well-positioned to navigate these challenges.

The combination of dividend income, potential capital appreciation, and defensive characteristics makes Merck an attractive consideration for diversified portfolios. However, investors should carefully evaluate their risk tolerance and investment timeline when considering pharmaceutical stocks, given the inherent volatility and regulatory uncertainties in this sector.

This analysis is based on publicly available information and should not be construed as investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.