Introduction to Amgen: A Biotechnology Giant

Amgen Inc. (NASDAQ: AMGN) stands as one of the world’s leading biotechnology companies, pioneering innovative treatments for serious illnesses through cutting-edge biological research and development. Founded in 1980 and headquartered in Thousand Oaks, California, Amgen has established itself as a global leader in discovering, developing, manufacturing, and delivering transformative human therapeutics.

The company’s commitment to unlocking the potential of biology for patients suffering from serious illnesses has made it a cornerstone investment in the biotechnology sector. With a market capitalization exceeding $150 billion and a diverse portfolio of established medicines alongside a robust pipeline of investigational therapies, Amgen continues to attract investor attention as a stable yet growth-oriented stock in the healthcare space.

Amgen’s Business Model and Revenue Streams

Core Product Portfolio

Amgen’s revenue generation stems from its comprehensive portfolio of biologic medicines across multiple therapeutic areas. The company’s flagship products include treatments for cancer, cardiovascular disease, inflammatory conditions, bone health, and kidney disease. Key revenue drivers include established blockbuster drugs such as Enbrel (etanercept) for inflammatory diseases, Prolia (denosumab) for osteoporosis, and Repatha (evolocumab) for cardiovascular conditions.

Manufacturing and Distribution Excellence

The company operates state-of-the-art manufacturing facilities globally, ensuring reliable supply chains for its complex biologic medicines. Amgen’s integrated approach to drug development, from research through commercialization, provides significant competitive advantages in bringing innovative treatments to market efficiently.

Research and Development Focus

Amgen invests heavily in R&D, consistently allocating approximately 20% of its revenue to research activities. This substantial investment in innovation drives the company’s pipeline development and maintains its competitive position in the rapidly evolving biotechnology landscape.

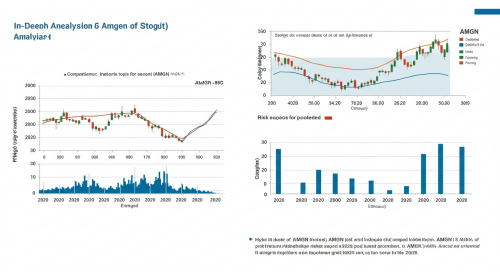

Recent Financial Performance and Q1 2025 Results

Strong Q1 2025 Performance Metrics

Amgen delivered impressive first-quarter 2025 results, with U.S. sales growing 14% and product sales increasing 11% year-over-year to $7.87 billion. Fourteen products delivered at least double-digit sales growth in the first quarter, including Repatha, BLINCYTO, TEZSPIRE, EVENITY, TAVNEOS, and UPLIZNA.

The company’s revenue growth of 9% in Q1 2025 demonstrates resilience and strong execution across its portfolio. EPS jumped 24% compared to the same period last year, reflecting improved operational efficiency and strong demand for key products.

Key Growth Drivers

Several factors contributed to Amgen’s robust Q1 performance:

Portfolio Diversification: The company’s diverse product portfolio across multiple therapeutic areas provides stability and reduces dependence on any single product line.

Market Expansion: Continued expansion into new geographic markets and therapeutic indications drives revenue growth for established products.

Operational Efficiency: Improved manufacturing efficiency and cost management contribute to enhanced profitability margins.

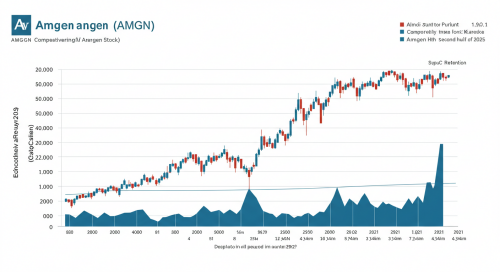

Current Stock Analysis and Analyst Sentiment

Analyst Ratings and Price Targets

The 20 analysts that cover Amgen stock have a consensus rating of “Hold” and an average price target of $322.3, which forecasts a 15.37% increase in the stock price over the next year. Price targets range from a low of $215 to a high of $405, indicating varied perspectives on the stock’s potential.

Analysts forecast that AMGN’s EPS will be $20.70 for 2025, with the lowest EPS forecast at $20.07, and the highest EPS forecast at $21.14. This earnings projection reflects confidence in the company’s ability to maintain profitability growth throughout 2025.

Technical Analysis Considerations

Technical analysis indicates potential overbought conditions and a high valuation, countered by Amgen’s strong financial performance and positive outlook from recent earnings calls. Investors should consider both fundamental strengths and technical indicators when evaluating entry points.

Pipeline Innovation and Future Growth Catalysts

MariTide: A Game-Changing Obesity Treatment

One of Amgen’s most promising pipeline assets is MariTide (maridebart cafraglutide), a long-acting, peptide-antibody conjugate for obesity treatment. In March 2025, Amgen announced the start of two late-stage trials for MariTide, an anti-obesity medication candidate. The global obesity treatment market represents a multi-billion-dollar opportunity, and successful development of MariTide could significantly impact Amgen’s growth trajectory.

Expanding Therapeutic Areas

Data for the drug Tezspire (tezepelumab), showed the best results for treating chronic rhinosinusitis with nasal polyps, demonstrating the company’s ability to expand indications for existing products and capture additional market opportunities.

Amgen maintains a robust pipeline leveraging state-of-the-art science and molecular engineering focused on the pursuit of transformative medicines with large effects in serious diseases, with human genetic validation used whenever possible to strengthen the evidence base.

Second-Half 2025 Outlook and Investment Considerations

Positive Growth Drivers

Pipeline Milestones: The second half of 2025 will be crucial for several pipeline programs, particularly MariTide obesity treatment data readouts that could significantly impact stock performance.

Market Expansion: Continued global expansion of key products, particularly in emerging markets, should contribute to revenue growth.

Regulatory Approvals: Potential new drug approvals and label expansions for existing products could provide additional revenue streams.

Potential Challenges and Risk Factors

Competitive Landscape: The biotechnology sector faces intense competition, with new entrants and biosimilar competition potentially impacting market share for established products.

Regulatory Environment: Changes in healthcare policy, drug pricing regulations, and FDA approval processes could affect future growth prospects.

Patent Expirations: Loss of patent protection for key products remains a long-term consideration, though Amgen’s diversified portfolio helps mitigate this risk.

Investment Thesis and Strategic Positioning

Strengths Supporting Investment Case

Established Market Position: Amgen’s position as a biotechnology leader with proven drug development capabilities provides a solid foundation for continued growth.

Financial Stability: Strong cash flows, robust balance sheet, and consistent profitability make AMGN an attractive option for dividend-focused investors.

Innovation Pipeline: Substantial R&D investment and promising pipeline assets position the company for future growth beyond current product lifecycles.

Valuation Considerations

Strategic expansions and successful product launches position the company well for continued growth, though investors should consider current valuation levels relative to growth prospects.

The stock’s current trading levels reflect both the company’s strong fundamentals and high market expectations. Potential investors should evaluate whether the current price adequately reflects the company’s growth prospects and pipeline potential.

Conclusion: AMGN’s Investment Outlook for Second-Half 2025

Amgen enters the second half of 2025 with strong momentum from excellent Q1 results, a promising pipeline, and solid market positioning. The company’s focus on innovation, particularly in high-growth areas like obesity treatment, positions it well for continued success.

While analyst consensus suggests moderate upside potential with price targets averaging around $322, the stock’s performance will likely depend on successful execution of pipeline programs, continued strong product sales, and effective management of competitive pressures.

For investors seeking exposure to the biotechnology sector, Amgen offers a compelling combination of established revenue streams, innovation-driven growth potential, and financial stability. The second half of 2025 will be particularly important for pipeline developments that could drive future stock performance.

Key Takeaways for Investors:

- Strong Q1 2025 results demonstrate operational excellence and market demand

- Diverse product portfolio provides revenue stability and growth opportunities

- Promising pipeline assets, particularly MariTide, offer significant upside potential

- Analyst consensus suggests moderate upside with price targets around $322

- Company’s financial strength and innovation focus support long-term investment thesis

The biotechnology sector remains dynamic and innovation-driven, making Amgen an attractive consideration for investors seeking exposure to this high-growth industry while maintaining focus on established, profitable operations.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.