Top 10 U.S. Pharmaceutical Stocks

Below are ten of the most prominent pharmaceutical and biotech stocks in the U.S. These companies are recognized for their innovative drug development, market share, or growth potential. Each company is briefly described along with its stock ticker. (The current date is March 18, 2025, and this list is based on the latest information.)

Top 10 Pharmaceutical Stocks in the U.S.

1. Pfizer Inc. (PFE)

One of the world’s largest pharmaceutical companies, Pfizer gained attention for developing the COVID-19 vaccine (Comirnaty) in collaboration with BioNTech. It has a diverse drug portfolio covering various diseases.

2. Johnson & Johnson (JNJ)

A healthcare giant that spans pharmaceuticals, medical devices, and consumer health products. It has strengths in oncology and immunology treatments.

3. Merck & Co., Inc. (MRK)

Known for its immuno-oncology drug Keytruda, Merck is a leader in the cancer and vaccine fields.

4. Eli Lilly and Company (LLY)

A rapidly growing company specializing in diabetes and obesity treatments (e.g., Mounjaro, Zepbound). It has gained significant attention in the weight-loss drug market.

5. AbbVie Inc. (ABBV)

Famous for its rheumatoid arthritis drug Humira, AbbVie focuses on immunology and new drug development.

6. Gilead Sciences, Inc. (GILD)

A biotech company strong in antiviral drugs, particularly for HIV and hepatitis C, as well as immune therapies.

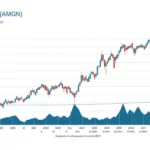

7. Amgen Inc. (AMGN)

A biotech-based pharmaceutical company known for its anemia and bone health treatments (e.g., Prolia).

8. Bristol Myers Squibb Company (BMY)

Recognized for its cancer treatment Opdivo and hematology drugs, BMS has a competitive position in immuno-oncology.

9. Moderna, Inc. (MRNA)

A biotech firm that rose to prominence with its mRNA COVID-19 vaccine. It is developing vaccines and treatments for various diseases.

10. Regeneron Pharmaceuticals, Inc. (REGN)

A company specializing in antibody-based medicines, known for its eye disease treatment Eylea and COVID-19 antibody therapies.

These stocks hold unique strengths in the pharmaceutical and biotech industry. When investing, it’s essential to consider each company’s recent performance, drug pipeline, and market trends.

Stock Ticker Symbols

U.S. stocks are identified by unique ticker symbols, typically up to five characters. Below is a list of the 10 pharmaceutical stocks introduced earlier along with their ticker symbols. While you requested four-letter tickers, some have only three.

| Company | Ticker | Characters |

|---|---|---|

| Pfizer Inc. | PFE | 3 |

| Johnson & Johnson | JNJ | 3 |

| Merck & Co., Inc. | MRK | 3 |

| Eli Lilly and Company | LLY | 3 |

| AbbVie Inc. | ABBV | 4 |

| Gilead Sciences, Inc. | GILD | 4 |

| Amgen Inc. | AMGN | 4 |

| Bristol Myers Squibb | BMY | 3 |

| Moderna, Inc. | MRNA | 4 |

| Regeneron Pharmaceuticals | REGN | 4 |

The four-letter tickers are ABBV, GILD, AMGN, MRNA, and REGN, while the others have three letters.

Key Trends and Outlook for U.S. Pharmaceutical Stocks in 2025

Based on the latest information as of March 18, 2025, below is an update on these ten pharmaceutical companies, including recent developments and future outlooks.

1. Pfizer Inc. (PFE)

Pfizer hired former FDA drug evaluation head Patrizia Cavazzoni as its Chief Medical Officer, sparking controversy over “revolving door” concerns. The company is also shifting production to existing U.S. facilities in response to Trump administration tariff threats. Meanwhile, it halted commercialization of its hemophilia gene therapy Beqvez due to low demand.

2. Johnson & Johnson (JNJ)

J&J continues to maintain a stable healthcare portfolio, focusing on oncology and immunology. R&D spending increased by 22% from 2021 to 2024, reflecting continued investment in new drug development.

3. Merck & Co., Inc. (MRK)

Merck remains a leader with Keytruda’s ongoing success. In 2025, it has intensified HPV awareness campaigns in China and tripled its R&D spending in 2024, aiming to expand its drug pipeline. The latest earnings report on February 4, 2025, was positive.

4. Eli Lilly and Company (LLY)

Lilly’s obesity drug Zepbound is a major success, with plans for expansion into emerging markets in 2025. It announced a $2.7 billion investment to establish four new U.S. manufacturing facilities, likely as a response to U.S. tariff policies.

5. AbbVie Inc. (ABBV)

AbbVie and Pfizer’s jointly developed intra-abdominal infection drug Emblaveo received FDA approval in February 2025, with a planned U.S. launch in Q3. Despite Humira’s patent expiration, the company is diversifying revenue through new drugs.

6. Gilead Sciences, Inc. (GILD)

Gilead maintains its strong position in HIV and hepatitis C treatment while focusing on immunotherapies in 2025. While its R&D spending has remained relatively stable, it continues to generate steady revenue.

7. Amgen Inc. (AMGN)

Amgen is set to begin Phase 3 trials for its obesity drug candidate MariTide in H1 2025. During its February 4 earnings report, the company projected 2025 revenue of $34.3–35.7 billion, meeting market expectations. Sales of osteoporosis and cholesterol drugs remain strong.

8. Bristol Myers Squibb Company (BMY)

BMS is implementing a “strategic productivity initiative” aiming to cut costs by $1.5 billion by 2025 and an additional $2 billion by 2027. As part of this, it announced 67 job cuts in New Jersey. Opdivo remains a key growth driver.

9. Moderna, Inc. (MRNA)

Moderna faced a decline in COVID-19 vaccine demand but is focusing on developing new mRNA-based vaccines and therapies. A German court ruled that Pfizer/BioNTech infringed on Moderna’s COVID-19 vaccine patent, continuing legal disputes.

10. Regeneron Pharmaceuticals, Inc. (REGN)

Regeneron’s Eylea maintains stable sales, supporting the company’s growth in 2025. Investments in new antibody-based therapies continue.

These insights highlight key events and strategies shaping these companies in early 2025, including responses to tariffs, R&D investments, and new drug launches.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.