Executive Summary

AstraZeneca PLC (NASDAQ: AZN) emerges as a compelling pharmaceutical investment opportunity in 2025, driven by exceptional oncology growth and strategic expansion across multiple therapeutic areas. With CEO Pascal Soriot’s ambitious target of $80 billion revenue by 2030 and strong analyst confidence reflected in elevated price targets, AstraZeneca presents investors with a unique combination of growth potential and dividend stability. The company’s post-COVID transformation into an oncology powerhouse, combined with its diversified pipeline and global market presence, positions it as a leading pharmaceutical investment for the second half of 2025.

Company Overview: A Pharmaceutical Innovation Leader

AstraZeneca, born from the 1999 merger of Swedish Astra AB and British Zeneca, has evolved into one of the world’s premier biopharmaceutical companies. Headquartered in Cambridge, UK, with significant operations across the globe, the company focuses on discovering, developing, and commercializing innovative medicines across oncology, cardiovascular, renal and metabolism (CVRM), respiratory and immunology (R&I), vaccines and immune therapies (V&I), and rare diseases.

Core Business Segments

Oncology: The crown jewel of AstraZeneca’s portfolio, oncology sales now comprise around 41% of total revenues, driven by blockbuster drugs including Tagrisso, Lynparza, Imfinzi, Calquence, and Enhertu.

Cardiovascular, Renal & Metabolism (CVRM): A rapidly growing segment featuring innovative treatments for diabetes, heart failure, and chronic kidney disease.

Respiratory & Immunology (R&I): Leveraging decades of expertise in respiratory medicine with treatments for asthma, COPD, and immune-mediated conditions.

Vaccines & Immune Therapies (V&I): Including RSV prevention therapies and next-generation vaccine technologies.

Rare Diseases: Specialized treatments for rare genetic and metabolic conditions, providing high-value niche market opportunities.

Current Financial Performance and Growth Trajectory

Outstanding Revenue Growth

AstraZeneca delivered exceptional financial performance in 2024, demonstrating the success of its strategic transformation:

- Total company revenue climbed 17% to $12.7 billion and operating profit jumped 22% to $3.1 billion in Q1 2024

- Total Revenue growth from Oncology was 24%, CVRM 20%, R&I 25%, V&I 8% and Rare Disease 16%

- Sales in its oncology segment rose 13% in the first quarter of 2025

Strong Dividend Performance

AstraZeneca maintains its commitment to shareholder returns through consistent dividend growth:

Second interim dividend declared of $2.10 per share, making a total annual dividend declared for FY 2024 of $3.10 per share, an increase of 7%. Dividend to be further increased in FY 2025

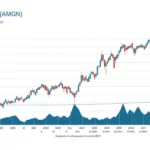

Stock Performance and Analyst Outlook

Compelling Price Targets and Forecasts

The investment community demonstrates strong confidence in AstraZeneca’s growth prospects:

- Based on 15 Wall Street analysts offering 12 month price targets for AstraZeneca in the last 3 months. The average price target is 13,125.00p with a high forecast of 16,500.00p and a low forecast of 10,900.00p. The average price target represents a 29.39% change from the last price of 10,144.00p

- The 3 analysts with 12-month price forecasts for AstraZeneca stock have an average target of 92.33, with a low estimate of 85 and a high estimate of 97. The average target predicts an increase of 31.77% from the current stock price of 70.07

- The 12-month stock price target is $95.0, which is an increase of 32.94% from the latest price

Revenue Forecasts and Growth Projections

Financial analysts project continued strong performance:

- Next quarter’s sales forecast for AZN is $14.07B with a range of $13.65B to $14.79B. AZN beat its sales estimates 75.00% of the time in past 12 months

- On average, 5 Wall Street analysts forecast AZN’s revenue for 2025 to be $89.4 billion

Analyst Consensus

Astrazeneca currently has an average brokerage recommendation (ABR) of 1.53 on a scale of 1 to 5 (Strong Buy to Strong Sell), indicating strong analyst confidence in the company’s prospects.

Strategic Initiatives and Pipeline Development

Oncology Excellence Strategy

AstraZeneca’s oncology success stems from its comprehensive approach to cancer treatment:

AstraZeneca’s strong oncology performance was driven by medicines such as Tagrisso, Lynparza, Imfinzi, Calquence and Enhertu (in partnership with Daiichi Sankyo)

Next-Generation Pipeline Development

The company continues investing in breakthrough technologies:

In breast cancer, it is also studying a so-called PARP inhibitor known as saruparib, which could potentially replace its $2 billion-a-year drug Lynparza. Antibody-drug conjugates, which pair the tumor-targeting of antibodies with the cell-killing power of chemotherapies, will continue to play a crucial role in the company’s oncology strategy.

Geographic Expansion and Market Access

AstraZeneca continues expanding its global footprint, with particular focus on emerging markets and strategic partnerships to maximize patient access and revenue potential.

Second Half 2025 Outlook: Key Growth Drivers

Oncology Portfolio Expansion

The second half of 2025 presents multiple catalysts for AstraZeneca’s oncology business:

Label Expansions: Continued expansion of approved indications for Tagrisso, Lynparza, and other key oncology assets should drive revenue growth.

New Drug Approvals: The company’s robust late-stage pipeline positions it for potential regulatory approvals that could significantly impact revenue.

Combination Therapy Development: Strategic combinations of existing drugs with new pipeline candidates offer opportunities for enhanced efficacy and market differentiation.

Cardiovascular Growth Acceleration

The CVRM segment’s 20% growth momentum provides a strong foundation for continued expansion in the second half of 2025, particularly with new diabetes and heart failure treatments gaining market traction.

Rare Disease Opportunities

The rare disease segment’s specialized focus and high-value treatments offer significant margin expansion opportunities as new therapies reach commercial maturity.

Strategic Listing Considerations

AstraZeneca chief executive Pascal Soriot is considering moving the company’s stock market listing to the United States, which could potentially unlock additional value for investors and improve market access.

Risk Factors and Challenges

Competition and Market Dynamics

The pharmaceutical industry’s competitive landscape presents ongoing challenges:

Biosimilar Competition: Key drugs face potential biosimilar competition that could impact pricing and market share.

Regulatory Environment: Changing healthcare policies and drug pricing regulations could affect profitability.

Clinical Trial Risks: The company’s growth depends on successful clinical trial outcomes for pipeline candidates.

Operational Considerations

Supply Chain Management: Global supply chain disruptions could impact manufacturing and distribution.

Intellectual Property: Patent expirations and intellectual property challenges require continuous innovation and portfolio renewal.

Investment Considerations

Compelling Investment Strengths

- Exceptional Growth Trajectory: Consistent double-digit revenue growth across multiple segments demonstrates strong execution capabilities.

- Oncology Leadership: Dominant position in oncology with proven blockbuster drugs and expanding pipeline.

- Diversified Portfolio: Balanced exposure across multiple therapeutic areas reduces concentration risk.

- Strong Cash Generation: Robust financial performance supports dividend growth and continued R&D investment.

- Strategic Vision: Clear long-term strategy with ambitious but achievable revenue targets.

Risk Management Factors

- Pipeline Execution: Success depends on continued clinical trial success and regulatory approvals.

- Market Competition: Intensifying competition in key therapeutic areas requires continuous innovation.

- Regulatory Uncertainty: Healthcare policy changes and pricing pressures represent ongoing risks.

Dividend Profile and Total Return Opportunity

AstraZeneca offers investors an attractive combination of growth potential and income generation. The company’s commitment to dividend increases, supported by strong cash flow generation and diversified revenue streams, makes it particularly appealing for income-focused investors seeking pharmaceutical sector exposure.

Conclusion: Positioning for Growth in H2 2025

AstraZeneca represents one of the most compelling pharmaceutical investment opportunities for the second half of 2025. The company’s successful transformation from a COVID-era vaccine manufacturer to an oncology powerhouse, combined with strong performance across all therapeutic areas, positions it for continued outperformance.

The combination of CEO Pascal Soriot’s ambitious $80 billion revenue target by 2030, strong analyst confidence reflected in price targets suggesting 30%+ upside potential, and consistent dividend growth creates a compelling investment proposition.

For investors seeking exposure to the pharmaceutical sector in the second half of 2025, AstraZeneca offers the rare combination of growth, income, and defensive characteristics that make it suitable for diversified portfolios. The company’s strategic focus on high-value therapeutic areas, robust pipeline development, and proven commercial execution capabilities suggest continued shareholder value creation.

Key factors to monitor in H2 2025 include pipeline progression, regulatory approvals, competitive dynamics, and the potential impact of strategic initiatives including the possible U.S. listing consideration. Overall, AstraZeneca’s strong fundamentals and strategic positioning make it a top-tier pharmaceutical investment opportunity.

This analysis is based on publicly available information and should not be construed as investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.