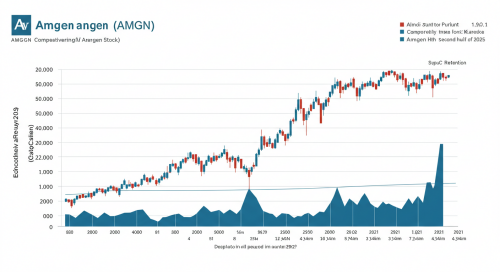

BREAKING: Trump Announces Potential 200% Pharmaceutical Tariffs – Market Impact Analysis

Latest Development from Trump Cabinet Meeting (July 9, 2025, 1:00 PM EST) In a significant policy announcement during today’s cabinet meeting, President Trump revealed a three-phase approach to pharmaceutical industry tariffs: Three-Stage Market Impact Analysis Stage 1: “Tariffs to be Announced Soon” Immediate Market Reaction (Negative) Stage 2: “1 to 1.5 Year Preparation Period” Transition … 더 읽기