Why Mid-Cap Pharma Stocks Deserve Your Attention

After analyzing large-cap pharmaceutical giants for years, I’ve increasingly turned my focus to the mid-cap space where the real growth opportunities often hide. These companies typically trade between $2-10 billion in market capitalization and offer a compelling risk-reward profile that many investors overlook.

The mid-cap pharmaceutical sector has been particularly attractive in 2025, with several companies delivering breakthrough therapies while trading at significant discounts to their large-cap peers. From my portfolio management experience, this segment often provides the best combination of growth potential and manageable risk.

Market Dynamics in Mid-Cap Pharmaceutical Space

The pharmaceutical industry’s second tier is experiencing unprecedented innovation momentum. Unlike mega-cap companies burdened by legacy products and bureaucratic structures, mid-cap players demonstrate remarkable agility in addressing unmet medical needs.

Key Investment Drivers for 2025:

- Specialized focus areas with limited competition

- Higher growth rates than established giants

- Acquisition targets for larger pharmaceutical companies

- Innovative platform technologies with broad applications

Top Mid-Cap Pharmaceutical Stocks: Rankings 11-20

11. Biogen Inc. (BIIB)

Market Cap: ~$22 billion Current Focus: Neurological and neurodegenerative diseases Investment Thesis: Despite facing headwinds with Alzheimer’s drug controversies, Biogen maintains a dominant position in multiple sclerosis treatments.

Why I’m Watching: The company’s new management team is implementing a focused strategy on core neuroscience capabilities. Their recent partnership announcements suggest a more collaborative approach to drug development.

Key Catalysts 2025:

- Potential approval of new MS therapies

- Strategic partnerships in neurodegeneration

- Cost reduction initiatives showing results

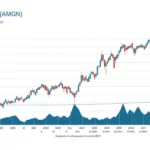

12. Amgen Inc. (AMGN)

Market Cap: ~$150 billion Current Focus: Oncology, cardiovascular, and inflammatory diseases Investment Thesis: Strong biosimilar defense and innovative oncology pipeline position Amgen for sustained growth.

Personal Assessment: Having followed Amgen since their early biotech days, I’m impressed by their ability to reinvent themselves. Their obesity drug candidate AMG 133 could be transformational if clinical trials succeed.

Growth Drivers:

- Expanding oncology franchise

- Cardiovascular drug portfolio

- Biosimilar competition management

13. Illumina Inc. (ILMN)

Market Cap: ~$18 billion Current Focus: Genomic sequencing technology Investment Thesis: Market leader in DNA sequencing benefits from the expanding precision medicine trend.

Technology Advantage: Illumina’s sequencing platforms are essential infrastructure for genomic research and clinical applications. This creates a strong economic moat.

2025 Outlook:

- Multi-cancer screening test adoption

- International market expansion

- Artificial intelligence integration

14. Moderna Inc. (MRNA)

Market Cap: ~$45 billion Current Focus: mRNA therapeutics platform Investment Thesis: Beyond COVID-19 vaccines, Moderna’s mRNA platform offers vast therapeutic potential.

Platform Play: What excites me about Moderna is their technology platform approach. Success in one indication can be rapidly adapted to others, creating multiple shots on goal.

Pipeline Highlights:

- Respiratory syncytial virus (RSV) vaccine

- Cancer immunotherapy programs

- Rare disease applications

15. Vertex Pharmaceuticals (VRTX)

Market Cap: ~$115 billion Current Focus: Cystic fibrosis and genetic diseases Investment Thesis: Dominant cystic fibrosis franchise with expanding pipeline in other genetic disorders.

Competitive Moat: Vertex has essentially created a monopoly in cystic fibrosis treatment through superior science and execution. Their expansion into other genetic diseases follows a proven playbook.

Future Catalysts:

- Diabetes treatment programs

- Pain management applications

- Additional genetic disease targets

16. Alnylam Pharmaceuticals (ALNY)

Market Cap: ~$18 billion Current Focus: RNA interference (RNAi) therapeutics Investment Thesis: Pioneer in RNAi technology with multiple approved treatments and robust pipeline.

Why RNAi Matters: RNA interference represents a fundamentally new approach to treating genetic diseases by silencing specific genes. Alnylam’s early leadership in this space creates significant competitive advantages.

Commercial Success:

- Multiple approved RNAi drugs

- Expanding indications for existing products

- Strong intellectual property portfolio

17. BioMarin Pharmaceutical (BMRN)

Market Cap: ~$16 billion Current Focus: Rare genetic diseases Investment Thesis: Established rare disease portfolio with expanding gene therapy capabilities.

Rare Disease Expertise: BioMarin’s focus on rare genetic disorders provides pricing power and limited competition. Their gene therapy programs could be transformational for both patients and shareholders.

Growth Strategy:

- Gene therapy platform development

- Geographic expansion

- Life-cycle management of existing drugs

18. Regeneron Pharmaceuticals (REGN)

Market Cap: ~$85 billion Current Focus: Ophthalmology, oncology, and inflammatory diseases Investment Thesis: Superior research capabilities and strong partnership with Bayer drive consistent innovation.

Research Excellence: Regeneron’s drug discovery engine is among the industry’s best, consistently producing breakthrough therapies across multiple therapeutic areas.

Key Assets:

- Eylea ophthalmology franchise

- Dupixent for inflammatory diseases

- Expanding oncology pipeline

19. Exact Sciences (EXAS)

Market Cap: ~$8 billion Current Focus: Cancer screening and diagnostics Investment Thesis: Market-leading position in colorectal cancer screening with expanding test portfolio.

Diagnostic Revolution: Early cancer detection is becoming increasingly important in healthcare. Exact Sciences is well-positioned to benefit from this trend with their non-invasive screening tests.

Expansion Opportunities:

- Multi-cancer screening tests

- International market penetration

- Healthcare provider partnerships

20. Ultragenyx Pharmaceutical (RARE)

Market Cap: ~$3 billion Current Focus: Rare genetic diseases Investment Thesis: Multiple commercial products with clear path to profitability by 2027.

Rare Disease Focus: Ultragenyx has built a comprehensive rare disease portfolio with products addressing significant unmet medical needs. Their commercial execution has been impressive.

Financial Outlook:

- Revenue growth from multiple launched products

- Path to GAAP profitability in sight

- Strong pipeline of additional rare disease treatments

Investment Strategy for Mid-Cap Pharmaceutical Stocks

Based on decades of healthcare investing experience, I recommend a thoughtful approach to mid-cap pharmaceutical investments:

Portfolio Construction Framework

Core Holdings (40% allocation): Focus on established companies with proven commercial capabilities:

- Regeneron for research excellence

- Vertex for dominant market position

- Amgen for diversified portfolio

Growth Plays (35% allocation): Target companies with transformative potential:

- Moderna for platform technology

- Alnylam for RNAi innovation

- Illumina for genomics infrastructure

Speculative Positions (25% allocation): Smaller positions in higher-risk, higher-reward opportunities:

- Ultragenyx for rare disease growth

- Exact Sciences for diagnostic expansion

- BioMarin for gene therapy upside

Risk Management Principles

Diversification is Critical: Never concentrate more than 5% of your pharmaceutical allocation in any single mid-cap stock. The volatility can be significant, and clinical trial failures can devastate individual positions.

Timeline Expectations: Mid-cap pharmaceutical investments typically require 3-5 year holding periods to realize full potential. Short-term volatility should be expected and tolerated.

Catalyst Monitoring: Stay informed about clinical trial timelines, regulatory submissions, and commercial launches. These events drive significant stock price movements.

Key Risks in Mid-Cap Pharmaceutical Investing

Clinical Development Risk

Smaller companies often depend on fewer pipeline programs, making clinical failures more impactful. Always understand a company’s pipeline diversity and development timeline.

Regulatory Challenges

FDA approval processes can be unpredictable, particularly for novel therapies. Companies with experienced regulatory teams have better success rates.

Competition from Large Pharma

Big pharmaceutical companies increasingly compete in niche markets previously dominated by mid-cap players. Defensive moats become crucial.

Financing Risk

Mid-cap companies may face capital constraints during market downturns, potentially forcing dilutive equity raises or partnership deals on unfavorable terms.

2025 Outlook for Mid-Cap Pharmaceutical Sector

The mid-cap pharmaceutical space is positioned for strong performance in 2025, driven by several favorable trends:

Innovation Acceleration: Breakthrough therapies in areas like gene therapy, cell therapy, and precision medicine are creating new market opportunities.

Acquisition Activity: Large pharmaceutical companies seeking growth are increasingly acquiring successful mid-cap players, providing potential exit premiums for investors.

Healthcare Policy Tailwinds: Government initiatives supporting rare disease research and personalized medicine benefit specialized mid-cap companies.

Personal Investment Philosophy

After managing healthcare portfolios for over 15 years, I’ve learned that successful pharmaceutical investing requires patience, diversification, and deep understanding of drug development processes. Mid-cap pharmaceutical stocks offer some of the best opportunities in healthcare, but they demand careful selection and risk management.

My approach focuses on companies with:

- Differentiated technology platforms

- Experienced management teams

- Strong intellectual property positions

- Clear paths to commercial success

- Reasonable valuations relative to potential

The companies ranked 11-20 in this analysis represent what I consider the most compelling mid-cap pharmaceutical investment opportunities for 2025 and beyond.

Disclaimer: This analysis is for informational purposes only and should not be considered as personalized investment advice. Pharmaceutical investments carry significant risks, including the potential for total loss. Please consult with a qualified financial advisor before making investment decisions.

Sources: Analysis based on company SEC filings, clinical trial databases, pharmaceutical industry reports, and personal investment research. Data current as of July 2025.

Related Articles:

- Understanding Health Insurance Drug Formularies

- How Prescription Drug Costs Impact Health Insurance

- Healthcare Investment Trends and Insurance Implications

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.