Latest Development from Trump Cabinet Meeting (July 9, 2025, 1:00 PM EST)

In a significant policy announcement during today’s cabinet meeting, President Trump revealed a three-phase approach to pharmaceutical industry tariffs:

- Immediate Action: Pharmaceutical industry tariffs will be announced “soon”

- Grace Period: The industry will have 1 to 1.5 years to prepare and adjust

- Potential Impact: Tariffs could reach as high as 200% on pharmaceutical imports

Three-Stage Market Impact Analysis

Stage 1: “Tariffs to be Announced Soon”

Immediate Market Reaction (Negative)

- Stock Price Decline: Major pharmaceutical stocks expected to drop 5-15%

- Investor Uncertainty: Selling pressure due to policy ambiguity

- Sector-Wide Impact: Pharmaceutical ETFs and related indices face downward pressure

- Volatility Surge: Trading volumes likely to spike as investors reassess positions

Stage 2: “1 to 1.5 Year Preparation Period”

Transition Phase Implications

- Strategic Planning Window: Companies gain crucial time to develop response strategies

- Temporary Relief Rally: Markets may partially recover on delayed implementation news

- Supply Chain Restructuring: Firms begin evaluating manufacturing relocation options

- M&A Activity: Potential consolidation as companies seek scale advantages

Stage 3: “200% Tariff Implementation”

Long-Term Structural Changes

- Cost Structure Overhaul: Import-dependent companies face tripled raw material costs

- Profit Margin Compression: Immediate profitability challenges for high-import firms

- Industry Consolidation: Smaller players may exit or merge

- Reshoring Acceleration: Massive shift toward domestic manufacturing

Specific Stock Impact Analysis

HIGH-RISK STOCKS (Severe Impact – 20-40% Decline Expected)

Teva Pharmaceutical (TEVA)

- Risk Factor: Heavy reliance on generic drugs manufactured in Israel and India

- Vulnerability: 70%+ of active ingredients sourced from Asia

- Expected Impact: Massive cost increases, potential dividend suspension

Mylan/Viatris (VTRS)

- Risk Factor: Significant generic drug portfolio with overseas manufacturing

- Vulnerability: Complex global supply chain heavily dependent on Indian facilities

- Expected Impact: Severe margin compression, restructuring required

Pfizer (PFE)

- Risk Factor: Despite U.S. presence, major manufacturing operations in Ireland and Belgium

- Vulnerability: Key drug ingredients sourced from China and India

- Expected Impact: 15-25% stock decline, margin pressure on generic portfolio

Bristol Myers Squibb (BMY)

- Risk Factor: Significant Puerto Rico operations (treated as imports under some tariff scenarios)

- Vulnerability: API sourcing from Asia for several key drugs

- Expected Impact: Moderate to severe impact depending on tariff scope

MEDIUM-RISK STOCKS (Moderate Impact – 10-20% Decline Expected)

Johnson & Johnson (JNJ)

- Risk Factor: Mixed manufacturing base with some overseas dependency

- Vulnerability: Consumer products division heavily reliant on international sourcing

- Expected Impact: Pharmaceutical division less affected, but consumer segment vulnerable

Merck & Co (MRK)

- Risk Factor: Some key facilities in Europe and emerging markets

- Vulnerability: Certain vaccine and oncology drug components imported

- Expected Impact: Selective impact based on product portfolio

AstraZeneca (AZN)

- Risk Factor: UK-based company with limited U.S. manufacturing

- Vulnerability: Potential classification as foreign entity subject to tariffs

- Expected Impact: Significant impact unless exempted as allied nation

Novartis (NVS)

- Risk Factor: Swiss-based multinational with complex supply chains

- Vulnerability: Generic drug division (Sandoz) heavily exposed

- Expected Impact: Material impact on generic operations

LOW-RISK STOCKS (Relative Advantage – 0-10% Decline or Potential Gains)

Eli Lilly (LLY)

- Advantage: Strong U.S. manufacturing base, especially for biologics

- Strength: Diabetes and obesity drugs largely produced domestically

- Expected Impact: Minimal direct impact, potential competitive advantage

AbbVie (ABBV)

- Advantage: Humira and other key biologics manufactured in U.S. facilities

- Strength: Limited generic drug exposure, strong pricing power

- Expected Impact: Potential market share gains from weakened competitors

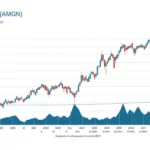

Amgen (AMGN)

- Advantage: Biotechnology focus with primarily U.S. manufacturing

- Strength: Complex biologics difficult to offshore

- Expected Impact: Competitive positioning improvement

Regeneron (REGN)

- Advantage: New York-based operations with domestic manufacturing focus

- Strength: Innovative biologics with strong IP protection

- Expected Impact: Potential beneficiary from reduced competition

Biogen (BIIB)

- Advantage: Massachusetts-based with U.S. manufacturing capabilities

- Strength: Specialty neurological drugs with limited generic competition

- Expected Impact: Minimal direct impact, potential pricing power increase

SPECIAL SITUATION STOCKS

Moderna (MRNA)

- Unique Position: mRNA technology with U.S.-based production

- Opportunity: Potential government support for domestic vaccine capability

- Expected Impact: Possible strategic beneficiary

Gilead Sciences (GILD)

- Mixed Profile: Some manufacturing overseas but key drugs produced domestically

- Consideration: Antiviral portfolio may receive special treatment

- Expected Impact: Moderate impact with potential policy exemptions

Investment Strategy by Risk Category

Immediate Actions (Next 30 Days)

SELL or REDUCE:

- Teva Pharmaceutical (TEVA)

- Viatris (VTRS)

- High-import dependency generics

HOLD with CAUTION:

- Pfizer (PFE)

- Bristol Myers Squibb (BMY)

- Foreign-based multinationals

CONSIDER ACCUMULATING:

- Eli Lilly (LLY)

- AbbVie (ABBV)

- Amgen (AMGN)

- Regeneron (REGN)

Medium-Term Strategy (1-6 Months)

Monitor for Opportunities:

- Quality names oversold due to sector-wide selling

- Companies announcing successful supply chain restructuring

- Merger arbitrage opportunities from industry consolidation

Avoid Until Clear:

- Generic drug manufacturers without U.S. production

- Companies with unclear supply chain disclosure

- Foreign pharmaceutical companies without U.S. partnerships

Long-Term Positioning (6+ Months)

Structural Winners:

- U.S.-based biotechnology companies

- Innovative drug developers with domestic manufacturing

- Companies completing successful onshoring initiatives

Potential Turnaround Plays:

- Beaten-down quality names that successfully restructure

- Companies with strong brands that can pass through costs

- Firms benefiting from reduced competition

Key Risk Factors to Monitor

- Tariff Scope Definition: Which products and countries are included

- Implementation Timeline: Specific dates and phase-in periods

- Exemption Categories: Critical drugs, rare diseases, national security

- Retaliation Measures: Foreign government responses affecting U.S. exports

- Healthcare Cost Impact: Consumer and government healthcare spending effects

Conclusion

The pharmaceutical tariff announcement creates a clear divide between import-dependent and domestically-focused companies. While the 1-1.5 year timeline provides adjustment opportunities, the potential 200% rate represents an existential threat to current business models.

Investment Thesis: Focus on U.S.-based biotechnology and specialty pharmaceutical companies while avoiding generic drug manufacturers with significant import dependencies. The coming restructuring will likely create both significant losses and substantial opportunities for positioned investors.

Key Takeaway: This policy shift favors innovation-focused, domestically-manufactured pharmaceuticals over cost-competitive, import-dependent generic drugs. Investors should prioritize companies with strong U.S. manufacturing capabilities and limited foreign supply chain exposure.

This analysis is based on the July 9, 2025 cabinet meeting announcement and current market expectations. Individual investors should conduct thorough due diligence and consult financial advisors before making investment decisions.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.