Company Overview: Gilead Sciences (NASDAQ: GILD)

Gilead Sciences stands as one of the world’s leading biopharmaceutical companies, specializing in innovative therapies for life-threatening diseases. Founded in 1987 and headquartered in Foster City, California, the company has built a reputation for developing breakthrough treatments across three core therapeutic areas: virology, oncology, and inflammation.

Core Business Segments

HIV/AIDS Treatment Leadership Gilead Sciences has established itself as the global leader in HIV treatment and prevention. The company’s HIV portfolio includes some of the most prescribed antiretroviral medications worldwide, generating substantial recurring revenue from long-term patient treatment protocols. Their innovative research pipeline continues to advance HIV care with cutting-edge approaches, including investigational long-acting therapies that could transform patient adherence and outcomes.

Hepatitis B and C Solutions The company’s antiviral expertise extends to hepatitis treatments, where Gilead has developed highly effective direct-acting antiviral (DAA) therapies. These treatments have revolutionized hepatitis C care, offering cure rates exceeding 95% in most patient populations.

Oncology Innovation Gilead’s oncology division focuses on developing targeted therapies for various cancer types. The company’s pipeline includes promising treatments for breast cancer, colorectal cancer, and other solid tumors, positioning it for significant growth in the competitive oncology market.

COVID-19 Response The company’s antiviral Veklury (remdesivir) became a cornerstone treatment for hospitalized COVID-19 patients, demonstrating Gilead’s ability to respond rapidly to global health emergencies while maintaining its position as an antiviral leader.

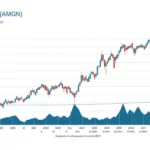

Financial Performance Highlights

Gilead Sciences maintains a strong financial foundation with consistent revenue generation from its established HIV franchise. The company’s diversified portfolio provides stability while new product launches and pipeline developments offer growth potential. Key financial strengths include:

- Robust cash flow from HIV treatment portfolio

- Strategic investments in R&D for pipeline expansion

- Strong balance sheet supporting continued innovation

- Dividend payments reflecting commitment to shareholder returns

2025 Second Half Stock Outlook

Wall Street Analyst Consensus

Based on 21 Wall Street analysts offering 12 month price targets for Gilead Sciences in the last 3 months, the average price target is $119.33 with a high forecast of $140.00 and a low forecast of $92.00. This represents significant upside potential from current trading levels, with analysts maintaining generally positive sentiment toward the stock.

Key Growth Catalysts for H2 2025

Pipeline Development Progress Gilead has a strong and diverse pipeline and is on track to achieve its ambition, set in 2019, of delivering 10+ transformative therapies by 2030. The company’s commitment to innovation positions it well for sustained growth beyond 2025.

HIV Innovation Leadership Gilead is fueling the next wave of innovation in HIV to help end the epidemic with breakthrough research including investigational long-acting therapies that could be administered twice yearly, potentially revolutionizing HIV treatment adherence and market dynamics.

Oncology Expansion Recent developments in cancer treatment research, including promising Phase 3 studies in triple-negative breast cancer and colorectal cancer partnerships, suggest significant revenue potential from oncology products in the coming years.

Investment Considerations

Strengths:

- Dominant market position in HIV treatment

- Robust financial performance and cash generation

- Strong pipeline with multiple late-stage candidates

- Strategic partnerships enhancing development capabilities

- Established regulatory expertise and global distribution

Potential Risks:

- Generic competition for older HIV medications

- Regulatory approval timelines for new therapies

- Competitive pressure in oncology markets

- Healthcare pricing pressures globally

Price Target Analysis

According to stock prediction models for 2025, GILD stock will be priced between $108.58 and $127.43 in 2025. This range suggests moderate upside potential with reasonable downside protection, making it an attractive consideration for both growth and income-focused investors.

Strategic Outlook

Gilead’s strategic focus on addressing unmet medical needs in HIV, oncology, and inflammation creates multiple avenues for growth. The company’s commitment to global health equity initiatives also positions it favorably for international expansion and partnership opportunities.

Key Upcoming Catalysts:

- Clinical trial results for pipeline candidates

- FDA approval decisions for new therapies

- Partnership announcements and strategic acquisitions

- Market expansion in developing countries

Investment Recommendation

Gilead Sciences presents a compelling investment opportunity for the second half of 2025, combining the stability of established HIV revenues with the growth potential of innovative pipeline developments. The company’s strong market position, robust financial profile, and commitment to breakthrough therapies make it an attractive consideration for investors seeking exposure to the biopharmaceutical sector.

The analyst consensus suggests favorable risk-adjusted returns, while the company’s strategic initiatives in HIV innovation and oncology expansion provide multiple pathways for sustained growth. However, investors should monitor competitive dynamics and regulatory developments that could impact future performance.

This analysis is for informational purposes only and does not constitute investment advice. Potential investors should conduct their own research and consider their risk tolerance before making investment decisions.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.