What is Novo Nordisk Stock?

Novo Nordisk A/S (NYSE: NVO) is a Danish multinational pharmaceutical company founded in 1923 and headquartered in Bagsværd, Denmark. As a leading global healthcare company, Novo Nordisk specializes in diabetes care, obesity treatment, and rare blood disorders. The company has become one of the world’s most valuable pharmaceutical companies, with a market capitalization exceeding $500 billion.

Key Products and Revenue Drivers

Ozempic (Semaglutide for Diabetes): Novo Nordisk’s flagship diabetes medication generated approximately $14 billion in sales in 2024, accounting for 41% of the company’s total revenue. The drug’s popularity has surged due to its weight loss side effects.

Wegovy (Semaglutide for Weight Loss): The company’s blockbuster obesity treatment achieved $4.5 billion in sales in 2024, with Wegovy sales jumping 107% year-on-year to 19.87 billion Danish kroner ($2.76 billion) in Q4 2024.

Insulin Portfolio: Traditional diabetes treatments including various insulin formulations continue to provide steady revenue streams.

Hemophilia Treatments: Novo Nordisk maintains a strong presence in rare blood disorder treatments through its biopharmaceuticals division.

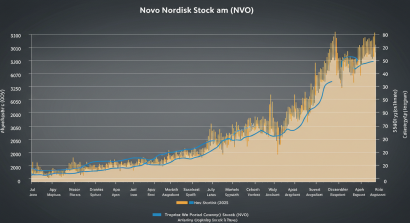

Novo Nordisk Stock Performance in 2024

Financial Highlights

Novo Nordisk delivered exceptional performance in 2024, driven primarily by unprecedented demand for its GLP-1 medications:

Full-Year 2024 Revenue: The company reported an increase in sales of 31% in Danish kroner and 36% at constant exchange rates to 232.3 billion kroner ($33.71 billion)

Net Profit Growth: Full-year net profit climbed 21% to 100.99 billion Danish kroner, beating estimates of 99.14 billion Danish kroner for 2024

Operating Profit: Fourth-quarter operating profit jumped 37% to 36.7 billion Danish crowns ($5.12 billion), better than the 33.6 billion forecast by analysts

Market Capitalization Milestone

Novo Nordisk hit $500 billion in market value during 2024, making it one of the most valuable pharmaceutical companies globally and placing it among Europe’s largest corporations by market cap.

GLP-1 Revenue Dominance

Global sales of Novo Nordisk’s top GLP-1 drugs, Ozempic and Wegovy, reached $26 billion in 2024, representing the core growth engine for the company. Ozempic alone accounted for 41 percent of Novo’s total sales in 2023, equivalent to nearly $14 billion, with two-thirds of the drug’s sales coming from the United States.

2025 Second Half Stock Outlook

Wall Street Analyst Predictions

Consensus Price Target: The 3 analysts that cover Novo Nordisk stock have a consensus rating of “Buy” and an average price target of $112, which forecasts a 60.41% increase in the stock price over the next year

Price Range: The lowest target is $64 and the highest is $160, indicating significant variation in analyst expectations.

Short-term Forecast: Market analysis anticipates a positive trend for Novo Nordisk A/S in July, with the forecasted price reaching $71.84 on June 29, 2025, which would represent 4.63% growth compared to the current price

Company Guidance for 2025

Sales Growth Expectations: For 2025, the company now sees sales growth of 13% to 21% at constant exchange rates, below the 16% to 24% previously forecast

Operating Profit Guidance: It predicted operating profit for 2025 would climb between 19% and 27%, compared to growth of 26% last year

Analyst Assessment: Novo Nordisk is eyeing sales growth at constant currencies between 16% and 24%—a range that analysts at ODDO BHF called “wide but reassuring”

Key Challenges in 2025

Supply Chain Recovery: The Danish pharmaceutical giant reported lower-than-expected first-quarter sales of its flagship obesity drug and lowered its full-year sales growth forecast

Competitive Pressure: While conceding that CagriSema’s weight-loss efficacy aligns with Lilly’s Zepbound, they see potential in Amycretin’s differentiation

Execution Focus: Both agree Novo’s focus must shift toward execution, particularly in meeting Ozempic and Wegovy supply targets

Long-Term Investment Outlook (2025-2030)

Five-Year Growth Projections

Market Opportunity: Novo Nordisk sees the obesity drug market expanding to $100 billion by 2030. With promising new treatments in the pipeline, 24/7 Wall St. projects huge upside through the end of the decade

Price Target 2030: Our target price is $192.34. Cumulatively, 24/7 Wall St. anticipates Novo Nordisk to appreciate 235.8% over the next five years

2026-2027 Forecast: In the first half of 2026, the Novo Nordisk price will climb to $98.77; in the second half, the price would add $11.45 and close the year at $110.22, which is +54% to the current price

Pipeline Development

Amycretin Potential: Early trials for oral Amycretin demonstrated notable weight loss, and strong upcoming data could accelerate its path to Phase III

CagriSema Development: The company continues developing next-generation obesity treatments to maintain competitive advantage.

Expanded Indications: Novo Nordisk is exploring additional therapeutic applications for existing GLP-1 medications.

Investment Risks and Opportunities

Growth Opportunities

Obesity Market Expansion: The global obesity treatment market represents a massive opportunity, with millions of patients seeking effective weight management solutions.

International Expansion: More than 90% of Wegovy’s sales came from the U.S., indicating significant potential for international market penetration.

Supply Chain Improvements: The company said Wednesday it more than doubled supplies of the starter dose of Wegovy in the United States, to address shortages

Diabetes Care Leadership: Novo Nordisk’s century-long expertise in diabetes care provides sustainable competitive advantages.

Key Risk Factors

Competitive Threats: Eli Lilly’s Mounjaro and Zepbound present significant competition in the GLP-1 space.

Supply Chain Challenges: Meeting unprecedented demand while scaling manufacturing remains a critical challenge.

Regulatory Scrutiny: The pair of medicines for diabetes and obesity have sold nearly $50 billion as of the second quarter and are on track to make $65 billion by the end of this year, attracting increased regulatory attention.

Patent Expiration: Future generic competition could impact profitability of key products.

Market Saturation: Eventually, the obesity treatment market may reach saturation, limiting growth potential.

Analyst Sentiment and Investment Recommendations

Bullish Perspectives

Bank of America: Despite shares tumbling 40% in the second half of 2024, they view Novo’s valuation as attractive, highlighting a robust 13% sales CAGR

Price Target: BofA has price target of 1,075 DKK on the stock

Valuation Attractiveness: Following significant stock price correction in late 2024, many analysts view current valuations as compelling entry points.

Cautious Outlook

Growth Deceleration: Some analysts express concern about slowing growth rates compared to the explosive growth seen in 2023-2024.

Competitive Pressure: Increased competition from Eli Lilly and emerging players may pressure market share and pricing.

Execution Risk: The company’s ability to meet supply targets and maintain growth momentum remains a key concern.

Technical Analysis for Second Half 2025

Support and Resistance Levels

Current Trading Range: NVO stock has established support around $65-70 and resistance near $110-115.

Moving Averages: The stock continues to trade above key moving averages, indicating overall bullish sentiment.

Volume Analysis: High institutional ownership and trading volume suggest continued strong interest from professional investors.

Volatility Considerations

Earnings Volatility: NVO typically experiences 5-15% moves following quarterly earnings announcements.

Sector Rotation: Healthcare stocks often outperform during market uncertainty, providing defensive characteristics.

Currency Impact: As a Danish company, NVO stock is subject to EUR/USD exchange rate fluctuations.

ESG Considerations and Sustainability

Environmental Initiatives

Novo Nordisk has committed to achieving carbon neutrality by 2030 and has implemented comprehensive sustainability programs across its operations.

Social Impact

Patient Access Programs: The company has established programs to improve global access to diabetes and obesity treatments.

Community Investment: Significant investments in Danish healthcare infrastructure and global health initiatives.

Governance Excellence

Board Composition: The company maintains strong corporate governance with diverse board expertise.

Transparency: Regular ESG reporting and stakeholder engagement demonstrate commitment to responsible business practices.

Investment Strategy Recommendations

For Long-Term Investors

Position Sizing: NVO represents a compelling core holding for healthcare-focused portfolios, with recommended allocation of 3-7%.

Dollar-Cost Averaging: Given volatility, implementing systematic investment strategies can help manage risk.

Dividend Considerations: While yield is modest, Novo Nordisk maintains a consistent dividend policy.

For Growth Investors

Thematic Exposure: NVO provides direct exposure to obesity treatment and diabetes care megatrends.

Innovation Premium: The company’s R&D capabilities and pipeline justify premium valuations.

Market Leadership: Dominant position in rapidly growing markets makes it attractive for growth-focused strategies.

For Value Investors

Valuation Reset: Following 2024 corrections, current valuations may present value opportunities.

Cash Flow Generation: Strong cash generation and profitability provide fundamental support.

Competitive Moats: Established market position and regulatory approvals create sustainable competitive advantages.

Conclusion: Investment Recommendation

Novo Nordisk stock presents a compelling investment opportunity for the second half of 2025, despite facing increased competition and supply chain challenges. The company’s dominant position in the rapidly expanding obesity treatment market, combined with its century-long expertise in diabetes care, creates a strong foundation for long-term growth.

Key Investment Thesis Points

- Market Leadership: Novo Nordisk’s Ozempic and Wegovy represent best-in-class treatments with proven efficacy and safety profiles.

- Massive Market Opportunity: The global obesity epidemic creates a multi-decade growth runway worth potentially $100 billion by 2030.

- Financial Strength: Strong cash generation and profitability support continued R&D investment and capacity expansion.

- Pipeline Potential: Next-generation treatments like Amycretin and CagriSema could provide additional growth catalysts.

Final Rating: BUY

With analyst price targets averaging $112 and long-term growth projections of 235.8% over five years, Novo Nordisk stock is rated as a BUY for long-term investors. The second half of 2025 should provide multiple opportunities for outperformance as the company addresses supply constraints and expands market access.

Risk Level: Moderate (due to competitive and regulatory risks) Time Horizon: 3-5 years for optimal returns Portfolio Allocation: 3-7% for diversified portfolios, up to 10% for healthcare-focused strategies

Investors should monitor quarterly earnings reports, competitive developments, and pipeline progress while maintaining a long-term perspective on this exceptional growth story in the pharmaceutical sector. The combination of proven products, expanding markets, and strong execution capabilities makes NVO an attractive investment for the second half of 2025 and beyond.

Hi, I’m Hibiki — the writer behind HealthManual.net.

I cover health insurance news, wellness tips, and insightful analysis of pharmaceutical and healthcare stocks. My goal is to simplify complex topics and make health and finance information more accessible to everyone.

Thanks for reading — I hope you find the content helpful and reliable.